Smart Finance in 2025: Build Wealth, Cut Debt, and Secure Your Future

Discover how to master personal finance in 2025 with smart budgeting, debt elimination, investing strategies, and passive income ideas. Learn how to secure your financial future and make smarter money decisions starting today.

Managing your finances wisely in 2025 isnt just smartits essential. With inflation, market shifts, and increasing digital opportunities, financial affiliate programs literacy can make or break your future. Whether youre saving for retirement, clearing debt, or growing passive income, here are 10 powerful strategies to take control of your money this year.

1. Budget Like a Pro

Use apps like Mint, GoodBudget, or YNAB to track income and spending. Categorize essentials (housing, food) and discretionary expenses (subscriptions, shopping) to find saving opportunities.

2. Build an Emergency Fund

Save at least 36 months of expenses in a high-yield savings account. This protects you during job loss, illness, or emergencieswithout needing credit cards.

3. Eliminate High-Interest Debt

Use the debt snowball (smallest balance first) or avalanche (highest interest first) methods. Pay off credit cards and personal loans quickly to save money long-term.

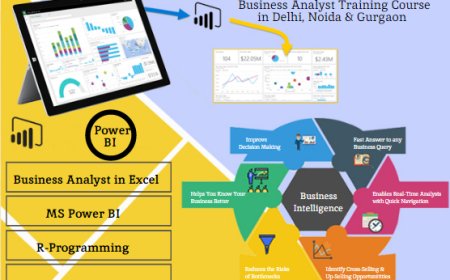

4. Invest Consistently

Investing is critical in 2025. Use mutual funds, ETFs, or retirement plans like PPF, NPS, or 401(k). Beginners can also try robo-advisors for automated investing.

5. Understand Your Credit Score

A healthy credit score means better loan approvals and lower rates. Pay bills on time, avoid overusing credit, and review credit reports regularly.

6. Automate Your Finances

Automate savings transfers and bill payments. This builds consistency, prevents missed deadlines, and removes the guesswork from monthly money management.

7. Keep Learning

Read finance books (Rich Dad Poor Dad, The Psychology of Money), listen to podcasts, and follow finance influencers to stay ahead of trends and build smarter habits.

8. Earn More with Side Income

Freelancing, blogging, and affiliate marketing are great passive income sources. Promote trusted finance programs to earn while helping others.

? For example, check out this list of high-converting offers:

<a href="https://vellko.com/blog/financial-affiliate-programs/" target="_blank" rel="dofollow">Vellkos Financial Affiliate Programs</a>

9. Set Financial Goals

Short-term: pay off debt, build savings.

Long-term: buy a home, invest for retirement, start a business. Break each into clear, measurable steps.

10. Consult a Financial Planner

If you're unsure, talk to a certified financial planner (CFP) who can personalize your budget, investments, and retirement plan.

\? Final Thoughts

Finance Affilaite in 2025 isnt about saving penniesits about making smart decisions, leveraging tools, and building a future of independence. Start small, stay consistent, and make your money work for you.