India VIX and Its Impact on Nifty 50: Insights for Corporate Clients

The "Volatility Index," better known as India VIX, measures market expectations for near-term volatility.

The "Volatility Index," better known as India VIX, measures market expectations for near-term volatility. The order book of Nifty options derives the index, which indicates the degree of expected fluctuation in the Nifty 50 index over the next 30 days. Corporate clients and institutional players use the India VIX to adopt a simplified approach for risk management and decision-making.

Understanding India VIX

Financial analysts compute India VIX using the Black-Scholes model based on the bid-ask prices of the Nifty options. A higher India VIX signifies wider price swings for the future, while a lower price swing indicates what the market expects in that vein. India VIX does not show direction but merely reflects the extent of expected volatility. Traders express the India VIX in percentage terms.

Relationship Between India VIX and Nifty 50

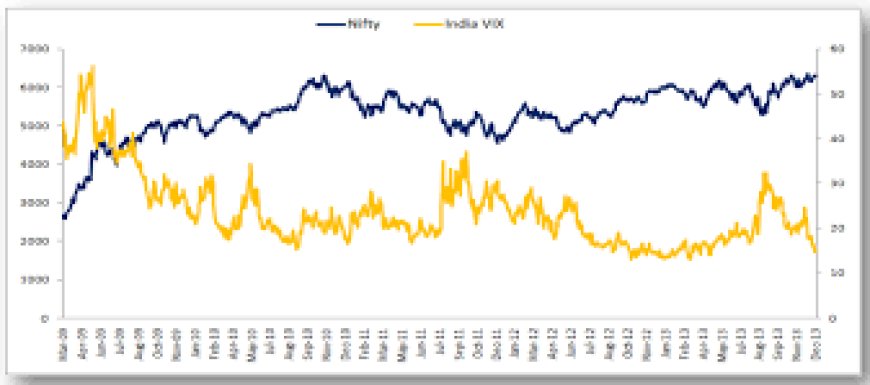

India VIX exhibits an inverse relation with the Nifty 50 index, meaning that generally declines in Nifty 50 see increases in India VIX and vice versa. Investors' perceptions and attitudes towards risk cause this inverse correlation. Investors tend to hedge their portfolios during uncertain periods, which increases demand for options, thereby raising implied volatility.

The India VIX serves as an indicator of sentiment and expected market movement for corporate clients managing equity investment portfolios. Higher levels of volatility may prompt corporations to review their equity market exposure or risk strategies.

India VIX and Nifty Next 50

Although India VIX calculates solely from Nifty 50 options, observers can also see its impact on broader indices such as Nifty Next 50. Companies forming part of the Nifty Next 50 are next in line for inclusion in the Nifty 50. Hence, movement patterns during high periods of market volatility tend to be distinct.

Movements in the India VIX may signal shifts in liquidity and appetite for risk in mid- to large-cap stocks. An increased India VIX usually brings about risk aversion and affects the volumes and performance of Nifty Next 50 constituents. For companies considering rebalancing their diversified portfolios, knowing how the India VIX translates into Nifty 50 or Nifty Next 50 becomes important.

Implications for Corporate Clients

Seek tools for evaluating market conditions for treasuries, investment committees, and institutional allocators, which India VIX delivers regarding all-important measures of volatility risk and necessary position changes. For example, a dramatic spike in India VIX may push firms to reduce exposure to markets or some alternative hedging instruments.

Risk managers might be inclined to design stress-testing models based on the India VIX. In back-testing their portfolios under various levels of VIX, corporates could assess the vulnerabilities of their positions. This exercise can help foster theoretical, more structured policies for capital allocation and financial risk assessment.

Many times, companies consider India VIX levels when raising funds or undertaking mergers and acquisitions. Highly volatile environments create opportunities for pricing inefficiency that can affect deal-making or valuation.

Trading and Hedging Considerations

In addition to option premiums, India VIX influences option prices. When India VIX rises, the cost of options increases. This situation affects both defined strategies of hedging and speculation. For example, corporates need to include the impact of higher implied volatility in their costing as they rely on options to hedge downside risks.

Corporate clients refer to India VIX as a benchmark for engaging or unwinding positions in hedging portfolios consisting of stocks in the Nifty 50 or Nifty Next 50. Trading desks in large corporations can also use VIX levels to indicate a risk-off or risk-on phase.

Many market participants overlook India VIX futures, which provide underlying exposure to volatility itself. Traders transact VIX futures over the NSE, and these do not feature in advanced hedging frameworks. Corporations benefit from these instruments, managing volatility without directional exposure.

Market Sentiment and Communication

Investor relations teams and corporate communication functions may use India VIX as a reference point to explain broader market conditions to their stakeholders. An increasing India VIX can signal caution looking ahead, while a declining index may indicate relative stability.

In considering the financial outlook, using India VIX as data-driven supporting valuation enables coherence in both messaging and data. This perspective is beneficial for public companies that need to maintain transparency in volatile environments.

Conclusion

India VIX remains a significant indicator in the Indian financial market landscape. Although it applies only to Indian stock markets concerning Nifty 50 options, it captures relevance for Nifty Next 50 and other segments as well.